WELCOME TO BENEFACTOR WEALTH MANAGEMENT

Next-Gen Wealth Management

Get a free portfolio Reviewed

Booking AppointmentReview My PortfolioWhat We Do

Consultation for Budgeting and expense management

Budgeting is the process of creating a plan to manage income and allocate funds for expenses, while expense management involves tracking and controlling costs to ensure financial stability and efficiency.

Consultation for Insurance And Taxation Planning

Insurance planning involves assessing risks and choosing appropriate policies to mitigate potential losses, while taxation planning entails strategizing to minimize tax liabilities and maximize savings within legal parameters.

Consultation for Investment And Succession Planning

Investment management involves overseeing the allocation of assets to achieve financial goals, while succession planning entails preparing for the transfer of wealth and responsibilities to future generations or successors.

We design solutions for the financial aspects of your life

Welcome to Benefactor Wealth Management, where we redefine wealth management for the modern era. Through the seamless integration of cutting-edge technology and innovative investment strategies, we empower our clients to achieve their financial goals with confidence and clarity. Our team of experts harnesses sophisticated algorithms and data analytics to craft personalized investment plans tailored to your unique needs and aspirations

Investment Management

Portfolio Hedging

Wealth Building

Succession Plan

Latest News

Retirement Planning: How to Save ₹5 Crore for a Chill Post-60 Life

Best Retirement Plans 2025: Plan Now for a Mast Retirement, Yaar! Picture this: You’re 60, sipping chai on a balcony in Goa, no EMIs, no office stress, just pure maza—maybe a Europe trip or spoiling your grandkids. Sounds like a desi dream, na? But here’s the hard truth: without a solid retirement plan, you might be stuck pinching paisa instead of living your best life. In India, where inflation’s running at 6–7% and life expectancy

Let’s Make Your Paisa Dance with Mutual Funds

Arre bhai, ever heard the saying, “Paisa paisa ko khinchta hai”? Well, it’s true, but only if you put your money to work! In India, where inflation’s running at 6–7% like a Virat Kohli century, keeping your paisa in a savings account is like leaving your biryani to get cold—total waste! Mutual funds are the desi way to grow your wealth, whether you’re saving for a swanky car, your kid’s IIT fees, or a chill

Achieving Financial Independence: The Role of a Wealth Manager in India

Achieving Financial Independence The Role of a Wealth Manager in India

Navigating Inheritance Tax Laws in India: Tips for Minimizing Tax Liabilities

Minimizing Tax Liabilities, Inheritance Tax Laws in India

Harnessing Private Trusts for Family and Succession Planning: A Strategic Approach

Private Trusts for Family and Succession Planning

Embarking on Your SIP Journey: 5 Tips for Success

5 essential tips for goal-based SIP investment

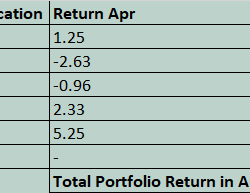

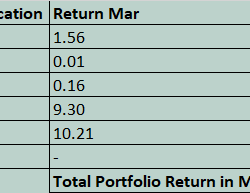

Optimizing Portfolio Returns: A Deep Dive into March 2024 Performance Analysis

Portfolio Returns, Asset Allocation.