Arre bhai, ever heard the saying, “Paisa paisa ko khinchta hai”? Well, it’s true, but only if you put your money to work! In India, where inflation’s running at 6–7% like a Virat Kohli century, keeping your paisa in a savings account is like leaving your biryani to get cold—total waste! Mutual funds are the desi way to grow your wealth, whether you’re saving for a swanky car, your kid’s IIT fees, or a chill retirement.

But here’s the catch: with thousands of mutual funds out there, picking the right one feels like choosing the perfect spice mix for your masala chai. No tension, yaar! At Benefactor Wealth, We’re here to break down the mutual fund funda for beginners. In this mast guide, we’ll show you how to choose the right mutual fund, avoid rookie mistakes, and let Benefactor Wealth’s expertise grow your paisa like nobody’s business. Chalo, let’s dive into the mutual fund mela!

What Are Mutual Funds, and Why Should You Care?

A mutual fund is like a big desi potluck—everyone pools their paisa, and a fund manager (the master chef) invests it in stocks, bonds, or other assets to make it grow. You buy “units” of the fund, and as the investments grow, so does your money. Here’s why mutual funds are a hit in India:

- Low Entry Point: Start with just ₹500/month via SIPs (Systematic Investment Plans).

- Diversification: Spreads risk across many companies, so one stock’s crash doesn’t sink your ship.

- Professional Management: Experts handle your investments, saving you time.

- Flexibility: Choose funds for short-term goals (debt funds) or long-term dreams (equity funds).

Fun Fact: As per AMFI’s 2024 report, over 4 crore Indians invest in mutual funds, with SIPs growing 25% year-on-year. That’s a lot of paisa dancing!

How a Mutual Fund Works

The Biggest Mistakes Beginners Make with Mutual Funds

Before we get to picking funds, let’s talk about the classic bloopers that can make your paisa cry:

- Chasing Past Returns: “Arre, this fund gave 20% last year, pakka winner!” Nope, past performance isn’t a guarantee.

- No Goal, Only Vibe: Investing without a purpose (e.g., “Bas, try karte hain”) leads to wrong fund choices.

- Panic Selling: Market dips, and you sell like it’s a fire sale. Patience is key, bhai!

- Ignoring Risk: High-return equity funds are great, but not if you need the money in 2 years.

At Benefactor Wealth, we’ve seen it all. Piyush Kumar’s team has helped clients like a 35-year-old Delhi doctor avoid these traps, turning her ₹50,000/month SIP into ₹70 lakhs in 7 years. Let’s learn how to pick the right fund like a pro.

Step 1: Define Your Goal and Time Horizon

Your mutual fund choice depends on why you’re investing and how long you can stay invested. Here’s a quick guide:

- Short-Term (1–3 years): Debt funds or liquid funds for safety (6–8% returns). Example: Saving for a new iPhone or a family vacation.

- Medium-Term (3–5 years): Hybrid funds (balanced equity + debt) for moderate risk (8–10% returns). Example: Down payment for a car.

- Long-Term (5+ years): Equity funds for high growth (10–15% returns). Example: Child’s education or retirement.

Desi Example: Priya, a 30-year-old Mumbai marketing manager, wants ₹15 lakhs for her wedding in 5 years. She starts a ₹20,000/month SIP in a hybrid fund, expecting 10% returns.

Benefactor Wealth’s Jugaad: We map your goals to the right funds. For Priya’s real-life counterpart, we recommended a balanced advantage fund, projecting ₹16 lakhs in 5 years.

Step 2: Understand Fund Types

Mutual funds come in different flavors, like a thali full of options. Here’s the lowdown:

- Equity Funds: Invest in stocks for high returns (10–15%). Best for long-term goals. Sub-types: Large-cap (safer), mid-cap (riskier), small-cap (high risk, high reward).

- Debt Funds: Invest in bonds or fixed-income securities for stability (6–8%). Ideal for short-term goals.

- Hybrid Funds: Mix of equity and debt for balanced risk (8–12%). Great for medium-term goals.

- Gold Funds/ETFs: Track gold prices for diversification (5–10%).

Desi Tip: Don’t put all your paisa in one fund—diversify like a proper desi thali with dal, sabzi, and dessert!

Step 3: Check Key Fund Metrics

To pick a winner, look at these factors:

- Past Performance: Compare 3–5 year returns against benchmarks (e.g., Nifty 50 for large-cap funds).

- Expense Ratio: Lower is better (e.g., 0.5–1% for direct plans). High fees eat your returns.

- Fund Manager’s Track Record: A seasoned manager is like a trusted cook—reliable.

- Risk Metrics: Check standard deviation (lower = less volatile) and Sharpe ratio (higher = better risk-adjusted returns).

Example: Fund A (large-cap) gave 12% over 5 years, has a 0.8% expense ratio, and a stable fund manager. Fund B gave 15% but has a 2% expense ratio and high volatility. Fund A is safer for beginners.

Benefactor Wealth’s Expertise: Our advisors analyse thousands of funds to pick the best for you. We helped a Hyderabad entrepreneur choose a large-cap fund that grew his ₹1,00,000/month SIP to ₹1.2 crore in 6 years.

Step 4: Start Small with SIPs

Don’t have a big lump sum? No problem, yaar! SIPs let you invest small amounts regularly, averaging out market ups and downs.

- How It Works: Invest ₹5,000/month in an equity fund. If the market dips, you buy more units; if it rises, your units gain value.

- Power of Compounding: ₹5,000/month at 15% for 10 years grows to ~₹13.15 lakhs and for 20 years grows to ~₹66.35 lakhs and for 30 years grows to ~₹2.81 Crores

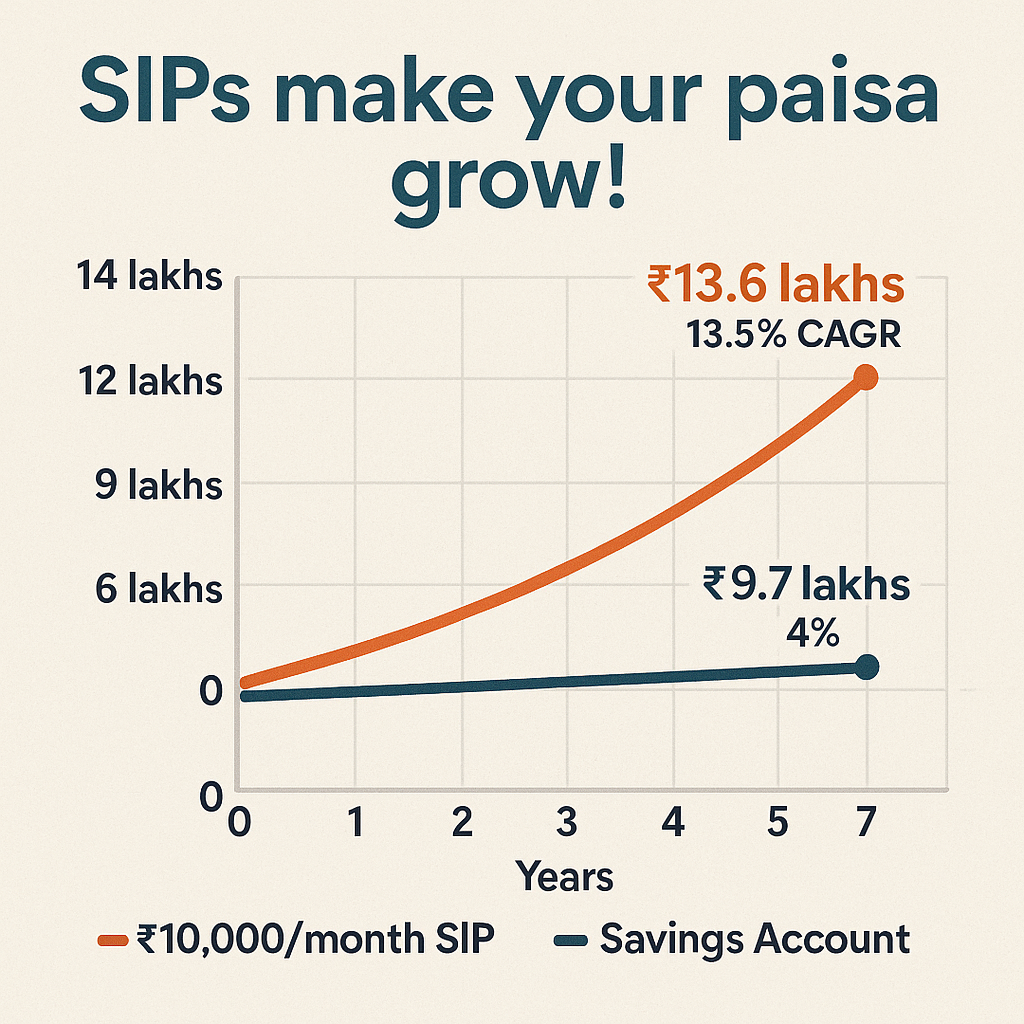

Desi Example: Raj, a 28-year-old Pune engineer, starts a ₹10,000/month SIP in a mid-cap fund for his dream startup in 7 years. At 13.5% returns, he’s on track for ₹13.6 lakhs.

SIP Growth Over Time

Benefactor Wealth’s Role: We set up SIPs tailored to your budget and goals, with auto-debit for discipline. Raj’s real-life counterpart hit his goal early with our fund picks.

Step 5: Monitor and Rebalance

Investing isn’t “set it and forget it.” Review your funds yearly to ensure they’re performing.

- Rebalance: If equity funds grow too much, shift some to debt for safety.

- Stay Calm: Markets fluctuate—don’t sell during a dip.

Desi Wisdom: As our uncleji says, “Thodi si mehnat, bada sa profit!”

Benefactor Wealth’s Support: Our advisors track your portfolio and suggest tweaks. We saved a Mumbai client from panic-selling during the 2020 market dip, preserving her ₹50 lakh gains.

How Benefactor Wealth Makes Mutual Funds Mast

Mutual funds can be your ticket to wealth, but picking the right one takes expertise. Benefactor Wealth makes it as easy as ordering dosa:

- Tailored Picks: We match funds to your goals and risk appetite.

- Expert Guidance: Our experience ensures your paisa is in safe hands.

- Desi Touch: We get your family pressures and lifestyle needs.

- Hassle-Free: From fund selection to paperwork, we handle it all.

As Piyush Kumar puts it, “Mutual funds aren’t just investments—they’re your paisa’s passport to growth!”

Conclusion: Start Your Mutual Fund Journey Today

Mutual funds are the perfect way to grow your paisa without breaking a sweat. By setting clear goals, choosing the right fund type, checking key metrics, starting with SIPs, and monitoring progress, you can build wealth like a pro. Benefactor Wealth is your partner in this mela, turning your financial sapna into reality.

Arre, kya soch rahe ho? Let’s make your paisa dance with mutual funds today!

Ready to start your mutual fund journey? Book a free 30-minute consultation with Benefactor Wealth’s experts to find the perfect fund for you!

Want more desi investment tips? Download our free eBook, Paisa Power: 10 Hacks to Grow Your Wealth, now! .

Follow us on LinkedIn or X for daily paisa-growing ideas, or drop a comment below with your mutual fund questions—hum hain na to sort it out!

If you are looking forward for financial services concider contacting us at contact@benefactor.co.in or Click Here.

For direct consultation or inquiries, please feel free to contact Mr. Piyush Kumar via email at contact@piyushkumar.in or visit website at www.piyushkumar.in.