Best Retirement Plans 2025: Plan Now for a Mast Retirement, Yaar!

Picture this: You’re 60, sipping chai on a balcony in Goa, no EMIs, no office stress, just pure maza—maybe a Europe trip or spoiling your grandkids. Sounds like a desi dream, na? But here’s the hard truth: without a solid retirement plan, you might be stuck pinching paisa instead of living your best life. In India, where inflation’s running at 6–7% and life expectancy is climbing (hello, 80+!), saving for retirement isn’t optional—it’s a must.

At Benefactor Wealth, founded by the paisa-savvy Mr. Piyush Kumar, we specialize in the best retirement plans 2025, making your retirement plan as easy as ordering paneer tikka. In this guide, we’ll show you how to save ₹5 crore, avoid common mistakes, and let Benefactor Wealth’s expertise ensure your golden years are truly golden. Chalo, let’s get cracking!

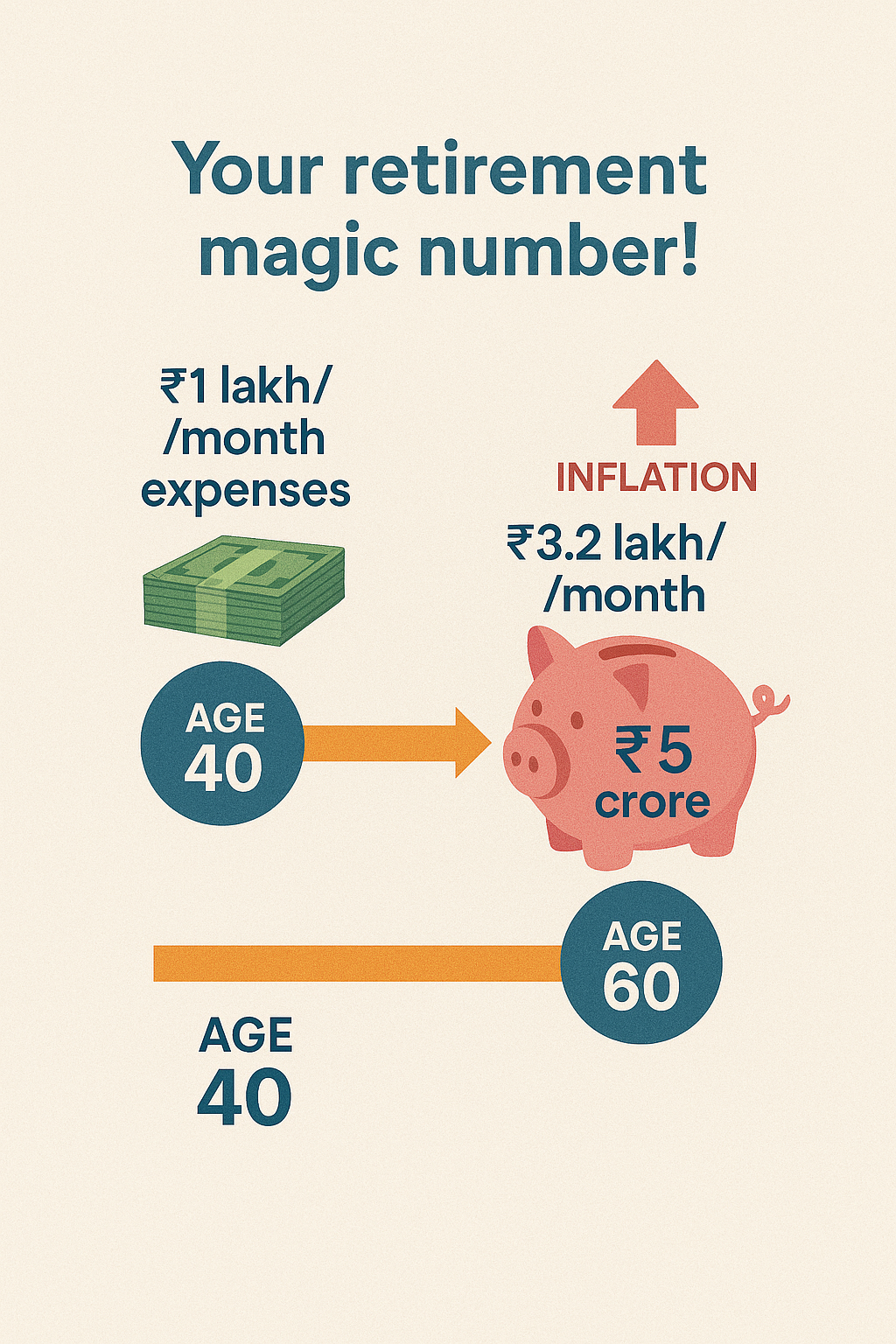

Why ₹5 Crore Is Your Retirement Magic Number

Why ₹5 crore? It’s not just a bada number—it’s what you need to maintain a middle-class or upper-middle-class lifestyle post-60, factoring in inflation and rising costs. Here’s the math:

- Monthly Expenses: Assume you need ₹1 lakh/month today (rent, food, travel, healthcare).

- Inflation Impact: At 6% inflation, ₹1 lakh in 20 years (age 40 to 60) becomes ~₹3.2 lakh/month.

- Corpus Needed: ₹5 crore, invested at 8% post-retirement (e.g., debt funds), generates ~₹3.2 lakh/month without depleting the principal.

This covers your basics, medical emergencies, and some maza like annual vacations. But saving ₹5 crore sounds like climbing Everest, right? Don’t worry—we’ve got a desi jugaad to make it doable.

Why ₹5 Crore?

The Biggest Retirement Planning Mistakes to Avoid

Before we dive into the plan, let’s dodge these classic bloopers that can derail your retirement sapna:

- Starting Late: Waiting till 50 to save means you need 3x more monthly savings than at 30.

- Underestimating Costs: Forgetting inflation or healthcare medical expenses is like ignoring a red light.

- Relying on PF Alone: Your Provident Fund won’t cut it—₹50 lakh max won’t fund a ₹5 crore lifestyle.

- No Diversification: Parking all paisa in FDs (6%) while inflation (7%) eats it away.

At Benefactor Wealth, we’ve seen these mistakes firsthand. We helped a 45-year-old Kolkata businessman rethink his “FD-only” strategy, growing his corpus from ₹80 lakh to ₹2 crore in 10 years. Let’s build your ₹5 crore plan the right way.

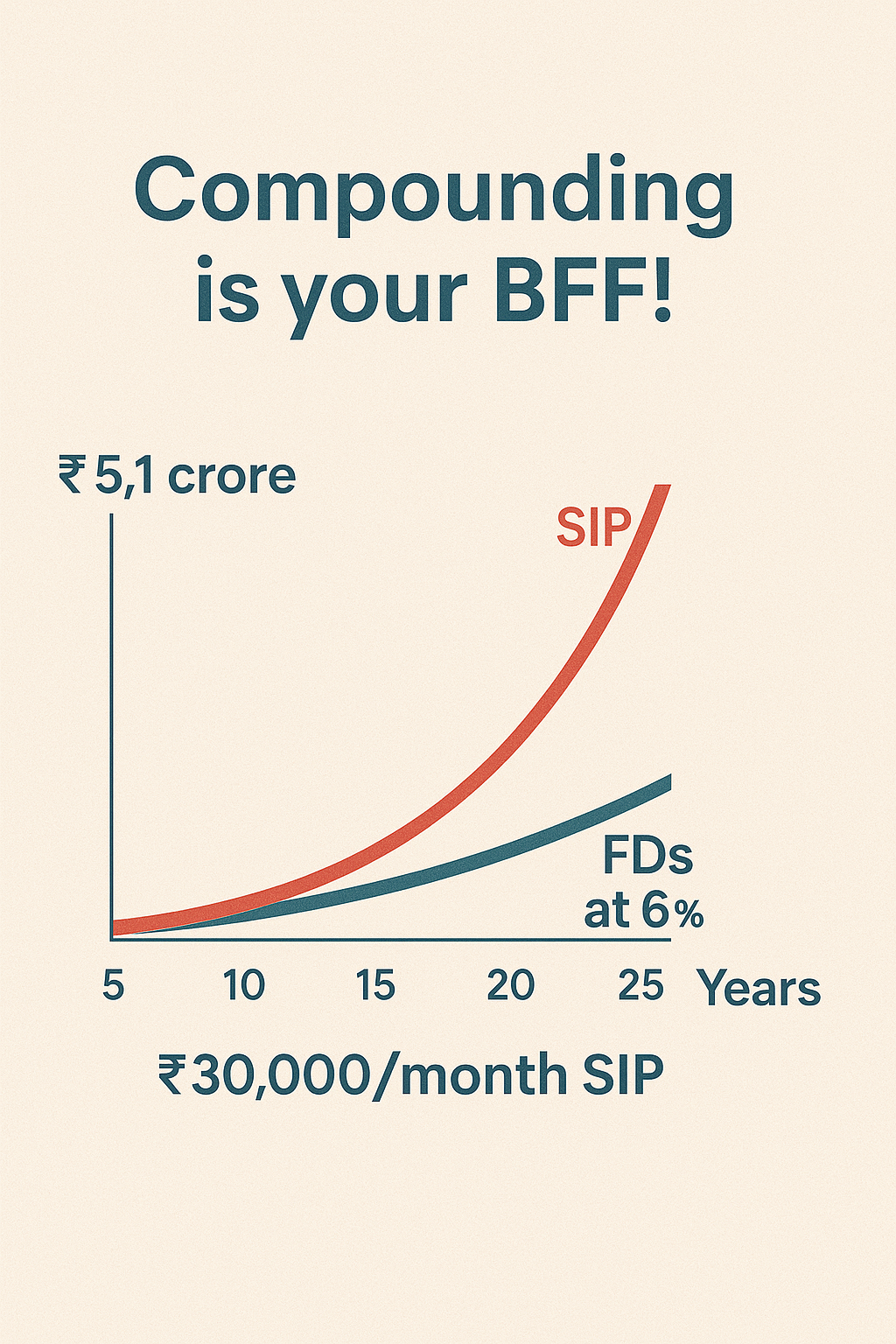

Step 1: Start Early and Calculate Your Monthly Savings

The earlier you start, the easier it is to hit ₹5 crore by 60, thanks to compounding. Let’s assume you’re 35 (25 years to 60). Here’s the math:

- Target: ₹5 crore in 25 years.

- Expected Return: 12% CAGR via equity mutual funds (realistic for long-term).

- Monthly SIP Needed: ~₹30,000/month grows to ~₹5.1 crore in 25 years.

Desi Example: Priya, a 35-year-old Bangalore IT manager earning ₹1.5 lakh/month, starts an ₹30,000/month SIP. At 12% returns, she’s on track for ₹5 crore by 60.

What If You’re Older?

- Age 45 (15 years): ~₹1.1/month at 12%.

- Age 50 (10 years): ~₹2.25 lakh/month at 12%.

Benefactor Wealth’s Jugaad: We run precise projections based on your income and goals. For Priya’s real-life counterpart, we adjusted her SIP to ₹30,000+ Top Up SIP by 20% annually to reach her retirement goal before the time.

Step 2: Build a Diversified Investment Portfolio

To hit ₹5 crore, diversify your investments like a desi thali:

- Equity Mutual Funds (60–70%): Large-cap and multi-cap funds for 10–15% returns. Example: ₹12,000/month in a large-cap fund.

- Debt Funds (20–25%): Liquid or short-term bond funds for stability (6–8%). Example: ₹4,000/month.

- Gold ETFs (5–10%): Hedge against volatility (5–10%). Example: ₹2,000/month.

- NPS (National Pension System): Tax-saving, equity-debt mix (8–10%). Example: ₹50,000/year for tax benefits.

Retirement Portfolio

Benefactor Wealth’s Expertise: Our advisors build tailored portfolios. We helped a Mumbai couple grow ₹1 crore to ₹9 crore in 12 years with a 70-20-10 mix and our expertise in analysing the future performing asset class and participating in it with larger exposure.

Step 3: Maximize Tax-Saving Investments

Taxes can eat your paisa, so use these to save more:

- ELSS Funds: ₹1.5 lakh/year under Section 80C, plus 10–12% returns.

- NPS: ₹50,000 extra deduction under Section 80CCD(1B).

- Health Insurance: ₹25,000–75,000 deduction under Section 80D.

Example: Save ₹2.25 lakh in taxes (30% bracket) by maxing ELSS, NPS, and health insurance. Reinvest the savings into your SIP.

Benefactor Wealth’s Role: Our tax experts optimize deductions. A Delhi client saved ₹3 lakh/year, boosting his retirement corpus by ₹1.24 crore over 15 years.

Step 4: Protect Your Retirement with Insurance

A medical emergency or early death can derail your plan. Get:

- Term Insurance: 10–15x annual income (e.g., ₹1 crore for ₹10 lakh income). Cost: ~₹20,000/year.

- Health Insurance: ₹25–50 lakh coverage. Cost: ~₹25,000/year.

- Critical Illness Cover: ₹25 lakh for diseases like cancer. Cost: ~₹10,000/year.

Desi Example: Rohan, a 40-year-old Chennai entrepreneur, gets ₹2 crore term and ₹50 lakh health cover, ensuring his ₹5 crore plan stays safe.

Benefactor Wealth’s Support: We recommend cost-effective plans. Rohan’s counterpart saved ₹12,000/year on premiums with our advice.

Step 5: Review and Rebalance Annually

Markets and goals change, so review your plan yearly:

- Rebalance: If equity grows too much, shift to debt for safety.

- Increase SIPs: As income rises, bump up contributions (e.g., ₹30,000 to ₹36,000).

- Stay Calm: Don’t panic during market dips—think long-term.

Desi Wisdom: “Thoda sa hisaab, bada sa profit,” as our uncleji says!

Benefactor Wealth’s Funda: Our advisors conduct annual reviews. We helped a Pune client rebalance during the 2023 dip, preserving ₹40 lakh in gains.

SIP Growth to ₹5 Crore

How Benefactor Wealth Makes Retirement Mast

Saving ₹5 crore sounds like a badi baat, but Benefactor Wealth makes it as smooth as butter chicken:

- Personalized Plans: Tailored to your income, goals, and risk appetite.

- Expertise: 20+ years of experience ensure safe growth.

- Desi Touch: We get family pressures and lifestyle needs.

- Transparency: No chhupa charges, only clear advice.

As Piyush Kumar says, “Retirement isn’t the end—it’s the start of your best life. Let’s plan it right!”

Your Chill Post-60 Life Awaits

Saving ₹5 crore for retirement is totally doable with early planning, a diversified portfolio, tax hacks, insurance, and annual reviews. Benefactor Wealth is your partner in this journey, turning your post-60 sapna into reality. Don’t wait till your hair’s all white—start today and live your retirement like a boss!

Arre, kya soch rahe ho? Let’s make your golden years truly mast!

Ready to save ₹5 crore for retirement? Book a free 30-minute consultation with Benefactor Wealth’s experts to get your personalised plan!

Want more desi money tips? Download our free eBook, Paisa Power: 10 Hacks to Grow Your Wealth, now! [Insert email capture link].

Follow us on LinkedIn or X or Facebook or Instagram for daily paisa-saving ideas, or drop a comment below with your retirement goals—hum hain na to help!

If you are looking forward for financial services concider contacting us at contact@benefactor.co.in or Click Here.

For direct consultation or inquiries, please feel free to contact Mr. Piyush Kumar via email at contact@piyushkumar.in or visit website at www.piyushkumar.in.