April 2024 has brought a mix of highs and lows for our investment portfolio, but ultimately, we have a reason to celebrate. Despite some challenges, our portfolio achieved a commendable return of 2.17%.

Let’s break it down:

- Equity: Our equity investments yielded a modest yet positive return of 1.25%, adding 0.11% to our portfolio. It’s a small but steady gain, reflecting our cautious optimism in the stock market.

- Short Term Debt: This category faced significant headwinds, with a sharp decline of -2.63%. It impacted our portfolio by -0.80%, reminding us of the inherent volatility and risks in short-term debt instruments.

- Long Term Debt: Though not as severe as short-term debt, long-term debt also saw a decrease of -0.96%, contributing -0.29% to our overall return. It’s a setback, but one that we anticipated could happen.

- Gold: Shining bright, our gold investments returned 2.33%, adding a healthy 0.35% to our portfolio. Gold once again proved its worth as a reliable hedge in turbulent times.

- Silver: The star performer of the month, silver soared with a return of 5.25%, contributing a substantial 0.80% to our overall return. This surge has been a delightful surprise, reinforcing our strategic allocation to this precious metal.

- Derivative Hedging: The standout element, our hedging strategies, provided a significant cushion, contributing a solid 2% to our returns. This underscores the importance of having robust hedging mechanisms in place.

In sum, while we faced challenges, especially in the debt categories, our diversified approach and strategic hedging have led us to a positive outcome. April 2024 has tested our resilience but also rewarded our strategic patience and diversification. Here’s to looking ahead with cautious optimism and continued strategic foresight!

Our investment portfolio showed a commendable return of 2.17%. Although we encountered challenges, particularly in the debt categories, our diversified approach and strategic hedging contributed to a positive outcome. This month tested our resilience, yet we are optimistic about the future and will continue to employ strategic foresight for sustained success in our asset allocation.

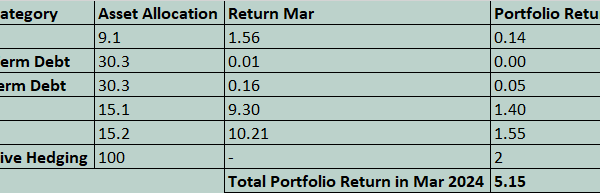

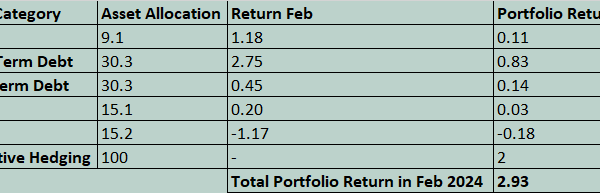

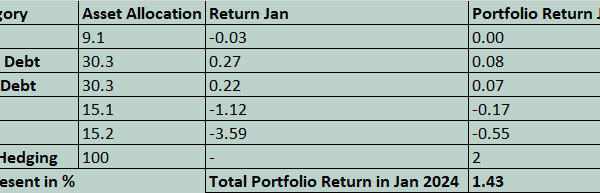

For March 2024 performance you can Click Here.

If you are looking forward for financial services concider contacting us at contact@benefactor.co.in or Click Here.

For direct consultation or inquiries, please feel free to contact Mr. Piyush Kumar via email at contact@piyushkumar.in or visit website at www.piyushkumar.in.